Visa Expands Stablecoin Support via Stellar, Avalanche

VISA’s stablecoin expansion has actually added support for Global Dollar (USDG), PayPal USD (PYUSD), Euro Coin (EURC) and also two new blockchain networks – Stellar and Avalanche. This VISA stablecoin expansion right now enables users to send and receive stablecoin payments through supported networks or even convert balances to traditional fiat currency.

Visa Stablecoin Expansion Boosts USDC, PYUSD, and EURC Adoption

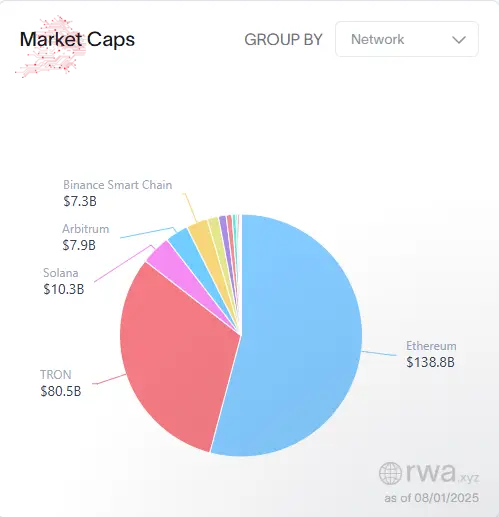

The integration actually allows USDC on Stellar to operate alongside existing Ethereum and also Solana support. PayPal PYUSD adoption is gaining momentum through Visa’s settlement platform right now, while EURC on Avalanche provides European users with faster cross-border payment options. This stablecoin blockchain integration builds upon Visa’s existing Circle USD Coin support that was already there.

Also Read: Mastercard’s Zero-Fee Crypto Card Challenges Visa in $253B Race

Growing Institutional Competition

VISA stablecoin expansion reflects rising institutional interest following the GENIUS stablecoin bill signing that happened recently. Major retailers like Walmart and Amazon are exploring their own stablecoins to benefit from reduced transaction fees and instant settlement times. USDC on Stellar offers enhanced cross-border capabilities, while PayPal PYUSD adoption continues expanding across various platforms right now.

Bank of America CEO Brian Moynihan has repeatedly mentioned plans to create a stablecoin and equip the bank with stablecoin payment rails. JPMorgan recently partnered with Coinbase to allow customers to link Chase accounts and convert rewards points to USDC, which demonstrates traditional banking adaptation to EURC on Avalanche and similar stablecoin blockchain integration trends that are happening.

Market Disruption Accelerates

Competition has been mounting as more institutions recognize the benefits. Noam Hurwitz, head of engineering at payments infrastructure company Alchemy, had this to say:

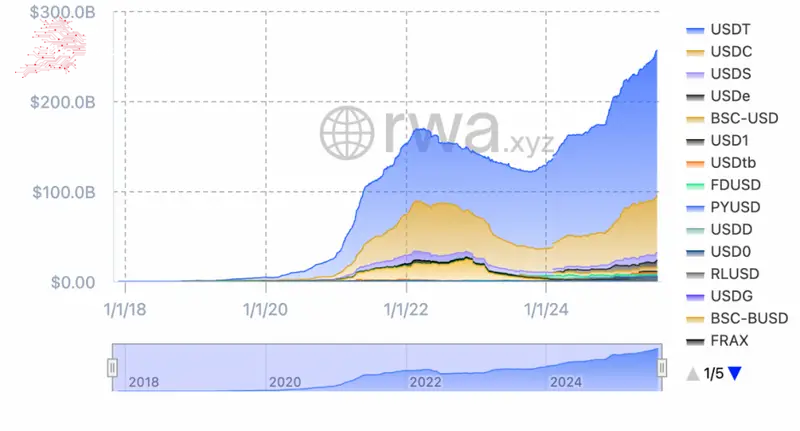

“Onchain stablecoin transaction volume has surpassed that of Visa and Mastercard and is becoming the default settlement layer for the internet”

Mastercard has acknowledged that stablecoins directly threaten payment processor business models. The company has already tokenized 30% of its transactions while collaborating with crypto companies. This VISA stablecoin expansion positions the company competitively as stablecoin blockchain integration becomes mainstream across financial services right now.

Also Read: Visa Launches Crypto Stablecoin Payments in Latin America

The expansion addresses growing demand for programmable money and instant settlement capabilities, with USDC on Stellar, PayPal PYUSD adoption, and EURC on Avalanche leading this transformation that’s happening across the industry.

Comments

Post a Comment