De-dollarization 2025: How the US Economy Is Undermining the Dollar

Countries worldwide are moving away from the U.S. dollar. This de-dollarization comes as the U.S. economy struggles with serious internal problems. These issues now threaten the dollar’s global trade position more than any foreign competition.

Former Federal Reserve and Treasury economists say America’s policies are the main risk to its currency’s power.

Also Read: META And Microsoft (MSFT) Stocks Fall, Pulling Down S&P 500

The Looming US Dollar Crisis: 2025 Outlook on Global Trade

Internal Economic Pressures Mount

The U.S. will face a $2.6 trillion federal budget deficit by 2034. Political deadlock blocks any real financial fixes.

As Kamin and Sobel note, “Given the political polarization of the country, the dysfunction of the US Congress, and the disinterest of politicians of all stripes in curbing the widening US budget deficit, this is hardly unthinkable.”

These domestic problems are the main threat to the dollar’s power, potentially accelerating de-dollarization process.

The Nations Leading The De-dollarization Push

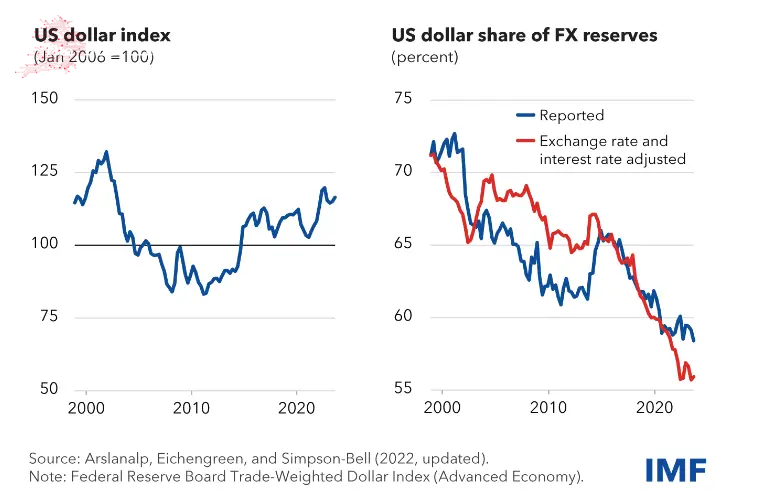

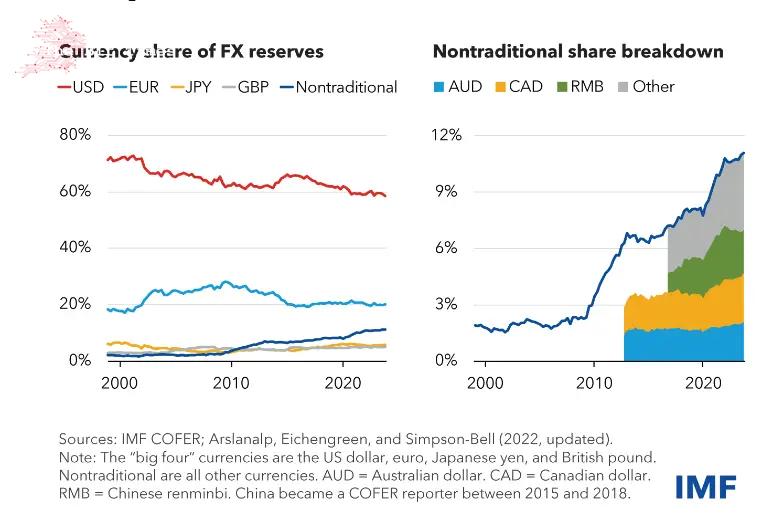

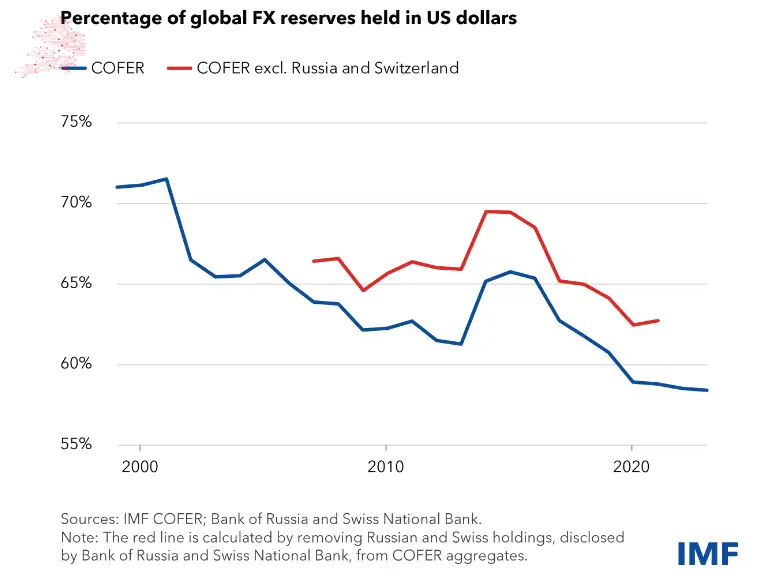

Countries from various economic alliances are working hard to reduce their reliance on the dollar for trade. Peter Schiff sees the Dollar Index dropping below 90 by 2025, marking a significant decline in the dollar’s world influence. In their push for de-dollarization, BRICS nations are switching to their local currencies for trade deals instead.

Also Read: BRICS: Is CBDC’s Next Phase of De-Dollarization Attempt?

Global Trade Implications

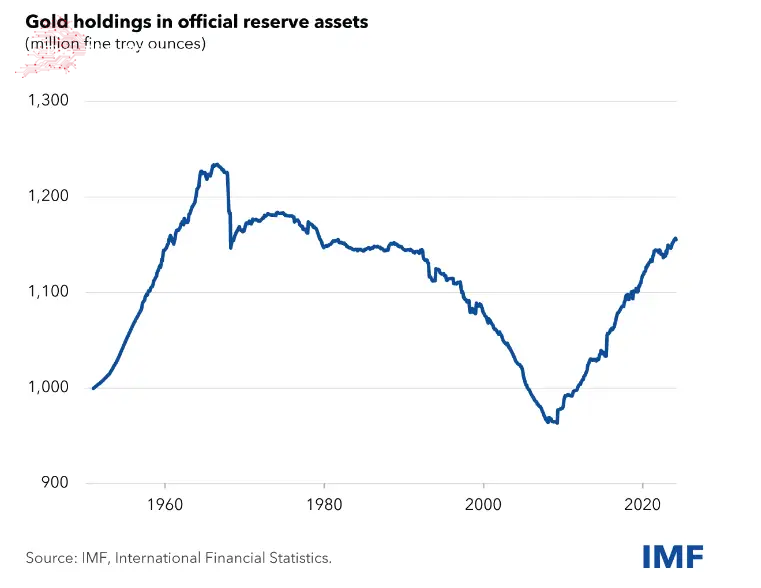

The dollar accounts for 88% of daily global trade and 55% of central bank reserves. However, developing countries use their own currencies more often for trade.

Research warns, “Global trade, productivity, and economic growth would likely be depressed, and implications for international political and military stability would also be adverse.”

This change shows growing worry about U.S. economic choices and moves towards de-dollarization.

Economic Stability at Risk

Experts warn that losing dollar dominance could cause a “sustained rise in inflation, crowding out of private investment, heightened financial volatility, and reduction in the dynamism of the US economy.”

These problems would affect financial markets and trade worldwide, and de-dollarization could severely impact economic stability.

Also Read: Meta Stocks Fall Nearly 5%: Why Investors Are Worried for 2025

Strategic Response Required

The U.S. must fix its economic problems and US dollar crisis to maintain the dollar’s global status. Without major policy changes and stricter spending controls, the dollar’s international importance will continue to fall. U.S. economic weakness and other countries’ actions towards de-dollarization will lead to big changes in global currency power by 2025.

Comments

Post a Comment